COLORADO CHILD CARE CONTRIBUTION TAX CREDIT

HELP KIDS AND SAVE MONEY ON YOUR STATE TAXES UPON FILING

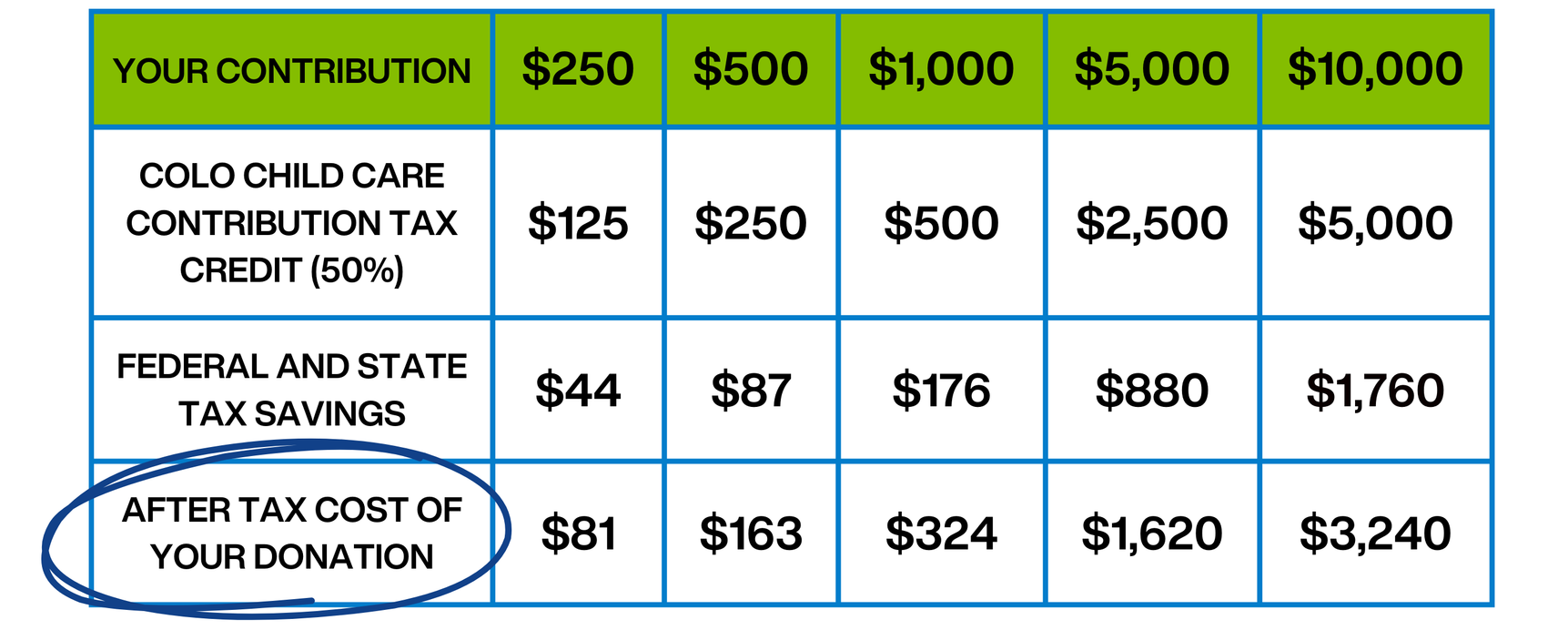

Taxpayers who make a monetary contribution to promote childcare in Colorado may claim an income tax credit of 50% of the total contribution. Both corporate and individual donors may benefit. Any taxpayer who makes a cash contribution to Boys & Girls Clubs of Pueblo County may claim an income tax credit of 50% of the total donation on your Colorado income tax return.

The most current information about the tax credit can be found at the Colorado Department of Revenue’s website: https://tax.colorado.gov/income-tax-topics-child-care-contribution-credit

GUIDELINES

The maximum credit you may take in any one year is $100,000 or your actual Colorado income tax liability for the year, whichever is less.

Any unused credit may be carried forward for up to five additional tax years.

Only monetary donations are eligible. This includes cash, checks, credit card transactions and IRA rollovers. Stock or other securities and in-kind gifts, such as labor or equipment, are not eligible but may qualify for other tax benefits.

In the case of donations associated with events, only the deductible portion of your payment, reduced by the value of goods and services received, is eligible. You will be advised of the net amount eligible for the credit.

Both individuals and corporations can take advantage of the credit.

BGCPC’s Tax ID: 23-7307508

Boys & Girls Clubs of Pueblo County

635 W. Corona Avenue, Suite 100 | Pueblo, CO 81004

719-564-0055 x106